Normally hume kisi bhi bank me account ke liye nearest bank branch jana padta hai or isme hume kafi pareshani face karni padti hai. Agar aap internet user hai to aapko bank shakha me jane ki jarurat nahi hai aap ghar baithe internet ke through kisi bhi bank me account ke liye apply kar sakte ho is post me main aapko ICICI bank me online new account open karvane ke bare me step by step details se bata raha hu. Is guide ko follow kar aap easily ICICI bank me new account khulwa sakte ho.

ICICI Bank aaj India ki top banks ki list me shamil hai or log international transaction ke liye mostly ICICI bank ya HDFC bank ki service hi use karte hai. Isliye agar aap koi online work karte ho to aapka ICICI bank me ya HDFC bank me account jarura hona chahiye taki aap other countries me online transaction kar sako.

- PAN Card Ke Liye Online Application Submit Kaise Kare

- Net Banking Kya Hai, Internet Banking Use Karne Ke Fayde or Nuksan

Online business ko success banane ke liye international transaction jaruri hai or international transaction ke liye aapke pass credit card ya global debit card hona jaruri hai. International transaction me ICICI bank ki service sabse best hai. To chaliye ab jante hai ki ICICI bank me account hkulwane ke liye apply kaise karte hai.

Online ICICI Bank Me Account Khulvane Ke Liye Apply Kaise Kare

First main aapko batana chahunga ki ICICI bank multiple type ke saving account offer karti hai jo is parkar hai.

- Regular Saving Account.

- Sliver Saving Account.

- 3 – in – 1 Account.

- Packet Saving Account.

- Basic Saving Account.

- Gold Privilege Account.

- Titanium Privilege Account.

- Young Star Saving Account.

- Senior Citizen Saving Account.

- Zero Balance Saving Account.

- Advantage Women Saving Account.

Itne type ke saving account list me dekh kar aapko confusing ho rahi hogi ki mujhe kis type ka account khulvana chahiye. Main aapko bata du ki is sabhi me se regular saving account sabse best choice hai. Sabse jyada people isi type ka account istemal karte hai.

Iska ek reason ya bhi hai isme kam deposits maintain karna padta hai jabki baki sabhi other type ke account me kafi jyada deposits maintain karna padta hai.

Regular saving account ki sabse achhi bat ya hai ki koi bhi Indian citizen s type ka account khulwa sakta hai or isme sirf 10, 000 rupees rakhne ki jarurat hoti hai. Regular saving account me aapko Internet banking, Mobile banking, Debit cards or other all services provide ki jati hai.

How to Apply Online ICICI Bank Account – Full Guide in Hindi

Iske liye aap ICICI bank ki site icicibank.com par jaye or Personal >> Account & Deposits >> Saving Accounts option open kare.

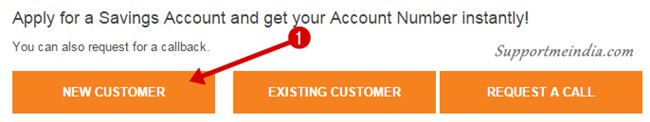

Agar aapko ICICI bank ki website par ye option na mile to iske liye aap yaha click kar saving accounts page par ja sakte hai Click here to open saving account. Ab yaha aapko new customer option par click karna hai.

- New Customer ke button par click kare.

Step 1: Enter Your State and City Names

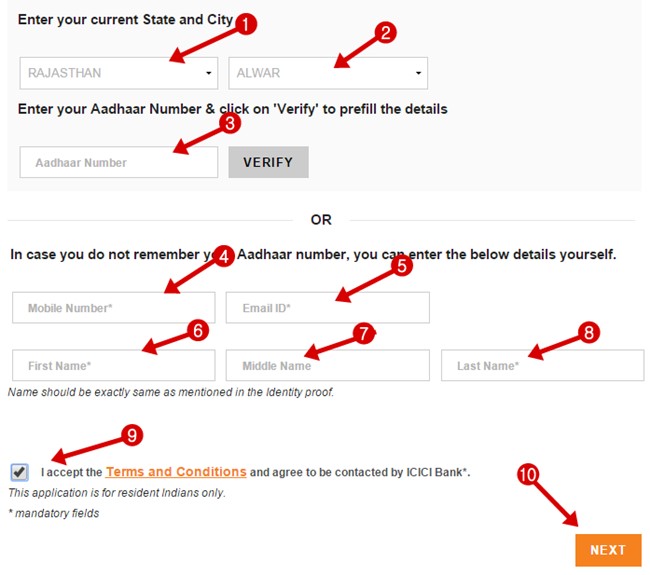

New customer open karte hi new tab me ek new page opn hoga usme aapko apne state or apne city ka name enter karna hai.

- Apna current state and city enter kare.

Step 2: Tell About Yourself

Aapke state or city name enter karte hi isi page me or option show honge jinme aapko apni detials fill karni hai.

- Apna state add kare.

- Apna city name add kare.

- Agar aapke pass aadhaar card hai to aap yaha aadhaar card number add kar sakte hai. Isse aapke aadhaar card ki information automaticlly form mr fill ho jayngi. Agar aadhar card nahi to koi bat nahi aap niche bataye steps follow kare.

- Apna moblie number add kare.

- Apna email address enter kare.

- Apna first name add kare.

- Ye option optional hai aap ise khali chod sakte hai iski jarurat nahi hai.

- Apna last name add kare.

- Terms & conditions par select kare.

- Next par click kare.

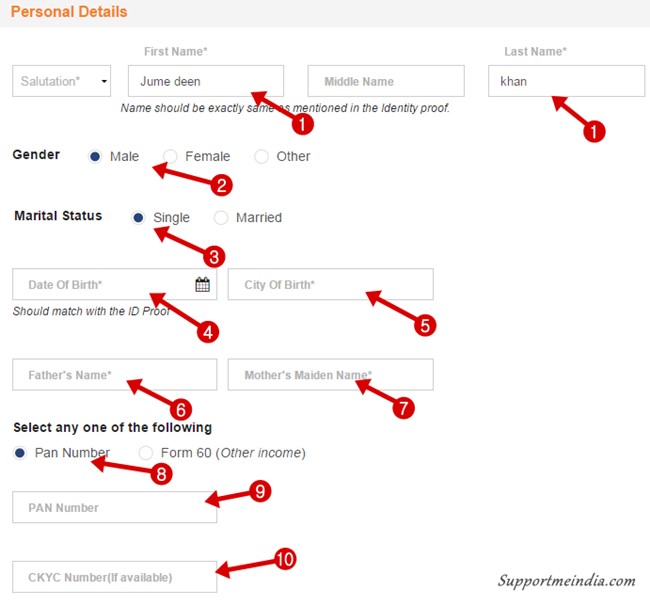

Step 3: Add Your Personal Information

Ab jo page open hoga usme aapko apni personal information fill karni hai. Isme Personal details, Communications details or Documents details ke 3 part hai isiliye main aapko tino ke bare me alag alag bata raha hu taki aapko aasani se samajh aa jaye.

1. Personal Details:

- Apna first name or last name check kare.

- Gender select kare.

- Marital Status select kare.

- Birthday date add kare.

- Birthday city select kare.

- Father name add kare.

- Mother name add kare.

- Pan number option choose kare. {Agar aapke pass PAN Card nahi hai to aap Form 60 (Other income) option select kar sakte hai magar iske liye aapke pass CKYS number available hona chahiye.}

- Apna pan card number add kare.

- Agar available hai to CKYS number add kare warna is option ko khali chod dijiye.

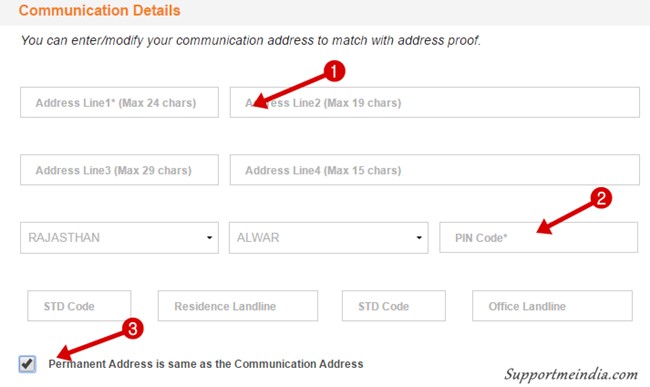

2. Communications Details:

Communications Details me aapko apna full address fill karna hai. Yaha aapko address fill karne ke liye 4 options milenge jinme se aap apna pura pata add kar sakte ho.

- Apna full address add kare.

- Apna pin code add kare.

- Permanent Address is same as the Communication Address ke samne select kare taki aapko fir se permanent address fill ne karna pade.

State or city name aap already add kar chuke ho or baki STD code, Residence landline and Offline Landline ki details avilable ho to aap add kare warna sabhi option ko khali chod sakte ho.

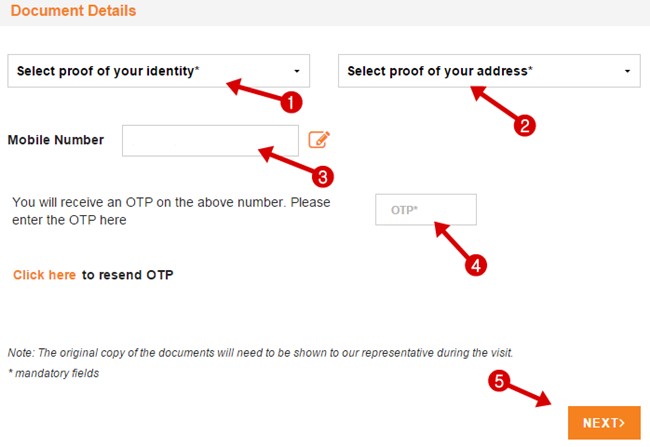

3. Documents Details:

Documents Details me aapko apna identity proof or address proof add karna. Iske liye aap apne aadhaar card, Driving licence, Job card, Pan card, Valid passport, Voter ID card etc. use kar sakte ho.

- Apna identity number proof or address proof select kare.

- Apna mobile number add kare.

- Aapke mobile number par ek OTP (One Time Password) aaya hoga wo yaha add kare. ( Agar OTP password nahi mila ho to aap resend OTP par click karke password fir se pa sakte ho.

- Next par click kijiye.

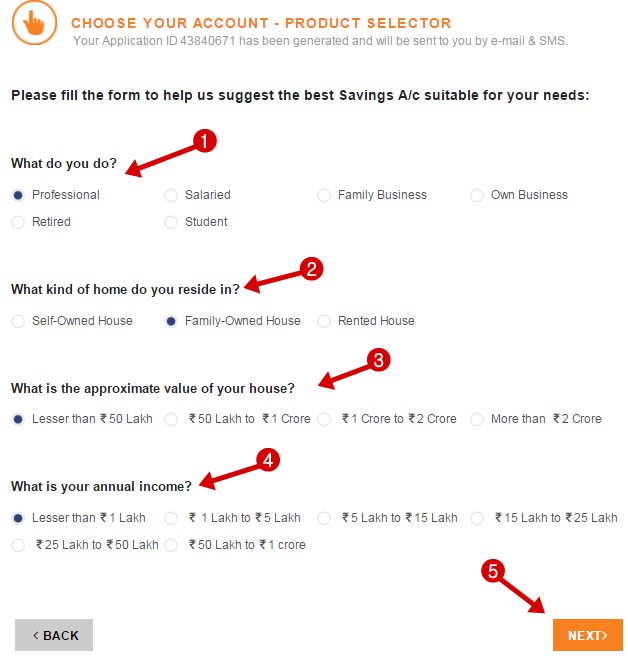

Step 4: Add Your Work, Home, House Value and Income Info

Ab jo page open hoga usme aapko apne work, home, house value or income ke bare me jankari fill karni hai.

- Aap Professional, Salaried, Family Business, Own Business, Retried and Student inme se aap jo bhi kaam karte ho o select kare.

- Aap alag special house me rahate hai to self-Owend-House, family ke sath rahate hai. Family-Owned House or agar aap kiraye se rahate hai to rented House select kare.

- Aapke home ki kitni value hai wo choose kare.

- Aapki income kitni hai wo selecr kare

- Next par click kare.

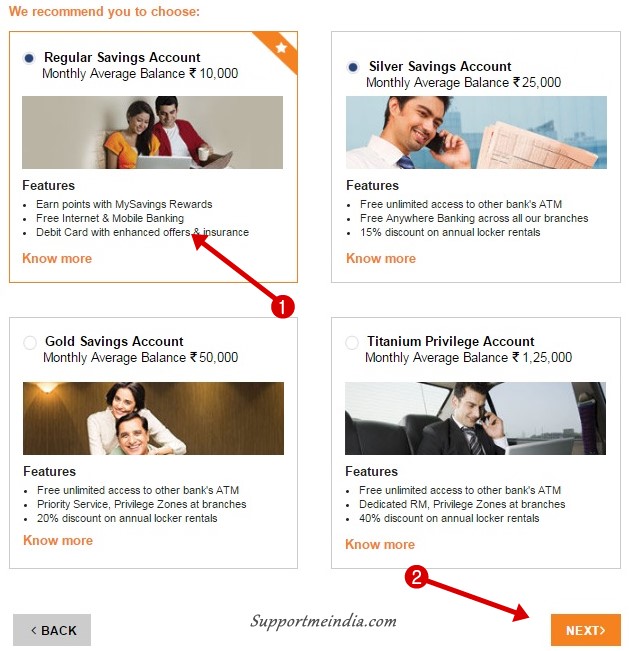

Step 5: Choose Which Saving Account You Need

Ab yaha par aapko saving account type select karna hai main iske bare me already bata chuka hu mere hisab se aap regular saving account choose kare.

- Regular Saving Account select kare.

- Next par click kare.

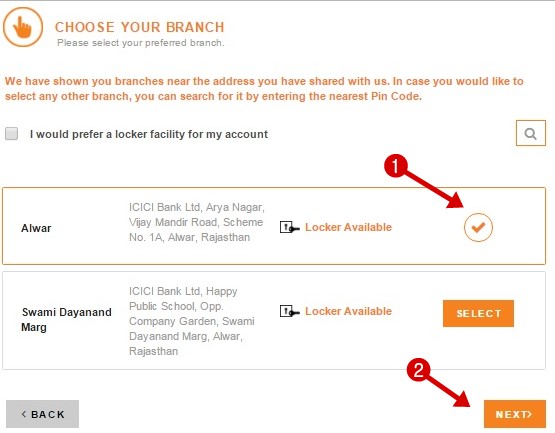

Step 6: Select Your Nearest Branch

Ab aapko apni nearest home branch select karni hai. Aapne address apply karte time jo address fill kiya tha aapko uske najdiki branch provide ki jayegi aap sabse nerest branch select kare taki aapko bank branch tak aane jane me koi problem ne ho.

- Apne sabse pass wali branch select kare.

Step 7: Add Account Opening Required Amount

Ab jo page open hoga usme aapko apne ICICI bank account me payment transfer karne ke liye kaha jayega. Aap net banking debit card se payment transfer kar sakte hai. Don’t worry ye paisa aapke saving account me hi add kiya jayega.

Aap chahe to bad me bhi payment kar sakte hai magar bad me aapko cheque ke through payment karna hoga. Agar aapke pass kisi or bank ki cheque book hai to aap transfer later ka option choose kar sakte ho.

- Aapko abhi payment karna hai to yaha amount add kare. (Aap 1,000 se 25,000 tak payment jama kar sakte ho.)

- Agar aapko payment bad me transfer karna hai to transfer later par click kare.

Step 8: Congratulations! You Applied Successfully for ICICI Bank Account

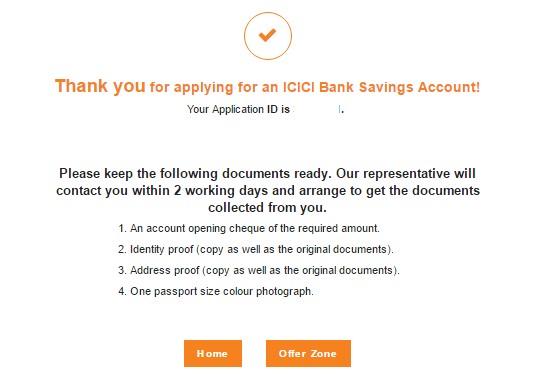

Ab agar apne sabhi steps proper follow kiye hai to is tarah ka ek message show hoga. Message me ye likha hoga Thank you for applying for an ICICI bank saving account. Isme aapki application ID hogi us ID number ki save kar le bad me iski jarurat padti hai.

Congratulations! Ab aap suceessfully ICICI bank saving account ke liye apply kar chuke ho magar abhi sirf saving account ke liye apply kiya hai abhi aapka ICICI me account bank me account nahi khula hai abhi aapko ek kaam or karna hai.

Step 9: Ready Your Important Documents

Aapke ICICI bank me saving account ke liye apply karne ke 24 e 48 hours bad ICICI bank representative aapko call karega or aapke documents collect karne ke liye aapke home address par kab bank member bheja jaye uski date and time or jaruri documents ready rakhne ke bare me bat karega.

Aap jo samay bataoge us time par ICICI person aapko call kar aapke bataye address par visit karega or aapse aapke documents collect karega. Isiliye aapko sabhi jaruri documents taiyar rakhne hai. Aapko ye important documents ready rakhne hai.

- An account opening cheque of the required amount: Aapko account me kitna payment transfer karna hai uska cheque ready rakhe or agar aapne already payment transfer kar diya hai to aapko iski jarurat nahi hai.

- Identity proof ( copy as well as the original documents ): Aadhaar card, Driving licence, Job card, Pan card, Valid passport, Voter ID card aap jisse identity proof karna chahate hai uski photocopy karwa le.

- Address proof ( copy as well as the original documents ): Same identity proof ki tarah aap address proof documents bhi taiyar rakhe.

- One Passport size color photograph: Apna passport size ka ek colorful photo banwa le.

Finally, documents and deposit collect hone ke bad aapka account open ho jayega isme 1 week tak ka time lag sakta hai.

Uske bad aapko bank passbook, cheque book, debit card, net banking kit provide ki jayegi. ICICI aapko or kya kya service degi iski jankari ke liye aap apni home branch par visit kar sakte hai.

Isi tarah aap other bank me bhi account khulvane ke liye online apply kar sakte ho. Agar aapko ye post achhi lagi hai or aap aesi hi or post padhna chahate hai to aap is site ke home page par ja kar hamari latest post check kar sakte hai. I hope aapko achhi information milegi.

For example, Aaop ye article padhe Online Digital Transaction Karte Time Safety Ke Liye 10 Jaruri Tips.

Agar aapko kisi or bank me account khulvana hai to aap uske bare me comment me bata sakte ho main aapke dwara batai gayi bank me online account khulvane ke bare me post likha dunga.

Agar aapko ye post pasand aaye to ise apni social media profile par apne friends ke sath share jarur kare. Thanks for reading.

Axis vs hdfc vs icici kaun sa bank accha hai sir for receive adsense payment and jo acchi service provide karti ho aur jiska debit card international transaction support karta ho. In sabke liye teeno me kaun best hai

SBI in sabse best hai baki in sab me extra charges jyada lagta hai. SBI global debit card se aap internation transaction kar sakte ho.

PayPal me account banan hai ICICI me 1000 he dalna hoga kya kuch kam pa bhee ho jayga

Nahi isse kam me account nahi khulega.

Great post.

nice article sir. ,, sir aaply karney key baad ,,passbook , atm etc .postal address par aayega ya bank sey collect karna padega. ,,,

Dono tarike use kar sakte ho.

Very nice article sir jee..

Bhai Kya ICICI Bank Me 10000 Balance Rakhna Jaruri Hai Jaise Meri Sallery 9000 Hai Mai Har Mahine Nikal leta Hu Tu Kya Isme Koi Problam Hogi

Ye aapke acocunt type ke upar depend karta hai. ICICI me aap 0, 25,000 and 1,00,000 tak wale account khulwa sakte ho.

Bhai Fir Ham Kaun Sa Account Open Kare Online

Already bta chkua hu ki kounsa account best hai.

Sir HDFC mai bhi kiya asie hi apply kar saktey hai

Usme bare me bhi jald post likhunga.

Sir kya ham 0 bailence par apni acount nahi kholva sakte hain kya?

mene post ko padha but payment vaali baat samajh nahi aaya

Jyada jankari ke liye aap bank branch me bat kare.